The Software as a Service (SaaS) industry has experienced significant growth in recent years, with an increasing number of businesses adopting cloud-based solutions for their software requirements. SaaS providers offer a diverse range of services, including customer relationship management (CRM), project management, accounting, and human resources applications. This model allows businesses to access software via the internet through a subscription-based system, eliminating the need for on-premises installation and maintenance.

The SaaS model offers several advantages, including increased flexibility and potential cost savings for businesses. One of its key benefits is scalability, allowing companies to easily adjust their user numbers, upgrade or downgrade services, and access new features without significant infrastructure changes or costly installations. This adaptability makes SaaS solutions attractive to businesses of various sizes, from startups to large corporations.

The recurring revenue model employed by SaaS companies generates a consistent and predictable income stream. This financial stability has made the SaaS industry an appealing investment opportunity for entrepreneurs and investors looking to enter the technology sector. As more businesses recognize the benefits of cloud-based software solutions, the SaaS industry is expected to continue its growth trajectory in the coming years.

Key Takeaways

- The SaaS industry is rapidly growing and evolving, with a focus on subscription-based software services.

- Profitable SaaS companies often have a strong customer base, high retention rates, and a unique value proposition.

- Potential for growth in SaaS companies can be evaluated through market trends, customer feedback, and scalability of the product.

- Assessing the financial health of SaaS companies involves analyzing key metrics such as recurring revenue, customer acquisition cost, and churn rate.

- Negotiating and acquiring a SaaS company requires thorough due diligence, understanding of the market, and strategic planning for integration and growth.

Identifying Profitable SaaS Companies

Evaluating the Product Offering and Market Fit

The company’s product offering and market fit are essential considerations. Is the company providing a unique and valuable solution to a specific market need? Does it have a strong customer base and a track record of customer satisfaction? These questions are vital in assessing the potential profitability of a SaaS company.

Assessing Revenue Growth and Retention Rates

Another critical factor is the company’s revenue growth and retention rates. A SaaS company with a high customer retention rate and a history of consistent revenue growth is likely to be a more attractive investment opportunity.

Understanding the Competitive Landscape and Market Positioning

It’s also essential to consider the company’s competitive landscape and market positioning. Is the company facing stiff competition from other SaaS providers, or does it have a unique advantage in the market? Understanding these factors can help investors identify profitable SaaS companies with strong growth potential.

Evaluating the Potential for Growth

In addition to identifying profitable SaaS companies, it’s important to evaluate the potential for growth within the industry. The SaaS industry has experienced rapid growth in recent years, and this trend is expected to continue in the coming years. As businesses continue to shift towards cloud-based solutions, the demand for SaaS products is expected to increase.

This presents a significant opportunity for investors looking to enter the industry. One key factor to consider when evaluating the potential for growth within the SaaS industry is market trends and demand. Are there specific industries or sectors that are driving demand for SaaS products?

Understanding these trends can help investors identify opportunities for growth within the industry. Additionally, it’s important to consider the global reach of the SaaS market. As businesses around the world continue to adopt cloud-based solutions, the potential for growth within the global SaaS market is significant.

Another important factor to consider is technological advancements and innovation within the industry. As new technologies emerge and existing technologies continue to evolve, there are opportunities for SaaS companies to develop new products and services that meet the changing needs of businesses. Understanding these trends and advancements can help investors identify opportunities for growth within the industry.

Assessing the Financial Health of SaaS Companies

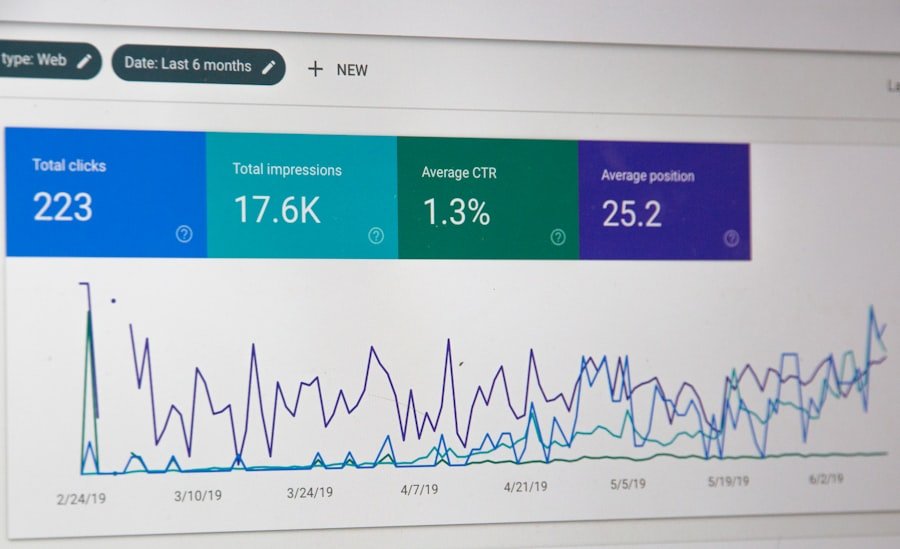

When considering an investment in a SaaS company, it’s important to assess the financial health of the company. This includes evaluating key financial metrics such as revenue growth, profitability, and cash flow. A SaaS company with strong financial performance is more likely to be a successful investment opportunity.

One key metric to consider when assessing the financial health of a SaaS company is recurring revenue. Recurring revenue is a key indicator of the stability and predictability of a SaaS company’s income stream. Companies with high levels of recurring revenue are more likely to have a stable and predictable cash flow, making them more attractive investment opportunities.

Another important factor to consider is the company’s profitability. While many SaaS companies may prioritize growth over profitability in the early stages, it’s important to evaluate the company’s path to profitability and its ability to generate sustainable returns for investors. Additionally, it’s important to consider the company’s cash flow and its ability to manage expenses and investments effectively.

Negotiating and Acquiring a SaaS Company

Once you have identified a profitable and growing SaaS company, the next step is negotiating and acquiring the company. This process involves careful consideration of several key factors, including valuation, due diligence, and deal structure. When negotiating an acquisition, it’s important to carefully evaluate the company’s financial performance, market positioning, and growth potential in order to determine a fair valuation.

In addition to valuation, due diligence is a critical step in the acquisition process. This involves conducting a thorough review of the company’s financials, operations, customer base, and intellectual property in order to identify any potential risks or liabilities. Due diligence is essential for ensuring that you have a clear understanding of the company’s business and financial health before finalizing an acquisition.

Finally, deal structure is an important consideration when negotiating an acquisition. This involves determining how the acquisition will be financed, as well as how ownership and control of the company will be transferred. It’s important to carefully consider these factors in order to ensure that the acquisition is structured in a way that aligns with your investment goals and objectives.

Managing and Growing Your SaaS Investment

Developing a Clear Growth Strategy

A key aspect of managing your investment is developing a clear growth strategy that aligns with the company’s strengths and market opportunities. This strategy should identify areas for growth, prioritize initiatives, and allocate resources effectively.

Optimizing Operations for Efficiency and Profitability

In addition to developing a growth strategy, it’s crucial to actively manage the operations of the company to drive efficiency and profitability. This may involve implementing new processes or technologies, optimizing sales and marketing efforts, or expanding into new markets or product offerings.

Building a Strong Team and Culture

Another critical aspect of managing your investment is building a strong team and culture within the company. A talented and motivated team can drive innovation and growth, creating value for investors. By focusing on building a strong team and culture, you can ensure that your investment continues to grow and succeed in the long term.

Tips for Success in the SaaS Industry

As you navigate your investment in the SaaS industry, there are several key tips for success that can help you maximize your returns and drive growth within your investment. First and foremost, it’s important to stay informed about industry trends and advancements in technology in order to identify new opportunities for growth within the industry. Additionally, it’s important to focus on building strong relationships with customers and understanding their needs in order to drive product innovation and market fit.

By prioritizing customer satisfaction and engagement, you can help ensure that your investment continues to grow and succeed in the long term. Finally, it’s important to remain flexible and adaptable in order to respond to changing market conditions and customer needs. The SaaS industry is constantly evolving, and by remaining flexible and adaptable, you can position your investment for long-term success in this dynamic industry.

In conclusion, investing in the SaaS industry presents significant opportunities for growth and profitability. By carefully evaluating potential investments, negotiating acquisitions, actively managing your investment, and staying informed about industry trends, you can position yourself for success in this rapidly growing industry. With careful consideration of these key factors and tips for success, you can maximize your returns and drive growth within your investment in the SaaS industry.

If you’re interested in learning more about investing in SaaS companies, you should check out the SaaS Marketplace website. They offer a variety of resources and articles on the topic, including a helpful guide on how to identify and buy profitable SaaS companies. You can find more information on their website here.

FAQs

What is a SaaS company?

A SaaS (Software as a Service) company is a business that provides software applications to customers over the internet, typically on a subscription basis.

How do you identify a profitable SaaS company?

To identify a profitable SaaS company, you can look at metrics such as monthly recurring revenue (MRR), customer retention rate, customer acquisition cost, and overall growth trajectory.

What are some key factors to consider when buying a SaaS company?

When buying a SaaS company, it’s important to consider factors such as the company’s financial health, customer base, technology stack, team expertise, and market potential.

What are the benefits of investing in a SaaS company?

Investing in a SaaS company can offer benefits such as recurring revenue streams, scalability, and the potential for high returns on investment.

What are some common challenges when investing in SaaS companies?

Common challenges when investing in SaaS companies include intense competition, evolving technology, customer churn, and the need for continuous innovation.