In the competitive world of SaaS (Software as a Service) marketplaces, securing funding for a startup can be a daunting task. However, a well-crafted pre-seed pitch deck can make all the difference when it comes to attracting potential investors. A pre-seed pitch deck is a visual presentation that provides an overview of a SaaS startup’s business plan, market opportunity, and financial projections. It serves as a crucial tool for entrepreneurs to communicate their vision and value proposition to potential investors in a clear and compelling manner.

The pre-seed stage is typically the first round of funding that a SaaS startup seeks, and it is crucial for laying the foundation for future growth and success. As such, creating an effective pre-seed pitch deck is essential for capturing the attention of investors and convincing them of the potential of the SaaS marketplace startup. In this article, we will explore the key components of an effective pre-seed pitch deck for SaaS funding, as well as provide tips for crafting a compelling story, understanding the investor list, designing impactful visual elements, and delivering an engaging presentation to SaaS investors.

Key Takeaways

- Pre-seed pitch decks are essential for SaaS marketplace startups to secure funding and attract investors.

- Key components of an effective pre-seed pitch deck include problem statement, solution, market opportunity, business model, and traction.

- Crafting a compelling story for startup funding in the SaaS marketplace involves showcasing the problem, solution, and market opportunity in a clear and engaging manner.

- Understanding the investor list for SaaS marketplace startups is crucial for targeting the right investors who are interested in the industry and stage of the startup.

- Design and visual elements play a crucial role in creating an impactful pre-seed pitch deck that captures the attention of investors.

- Tips for delivering an engaging pre-seed pitch presentation to SaaS investors include practicing the pitch, being confident, and engaging the audience with a compelling story.

- After pitching to investors, SaaS marketplace startups should focus on next steps such as following up with investors, refining the pitch deck, and preparing for due diligence.

Key Components of an Effective Pre-Seed Pitch Deck for SaaS Funding

A well-crafted pre-seed pitch deck for a SaaS marketplace startup should include several key components that effectively communicate the value proposition and potential of the business. Firstly, the pitch deck should begin with a compelling introduction that clearly articulates the problem that the SaaS startup aims to solve. This should be followed by a detailed explanation of the solution that the startup offers, highlighting its unique selling points and competitive advantages in the marketplace.

Furthermore, the pitch deck should include a thorough market analysis that demonstrates a deep understanding of the target audience, competition, and potential for growth. This should be supported by a solid business model and revenue strategy that outlines how the SaaS startup plans to generate income and sustain profitability. Additionally, the pitch deck should provide a clear overview of the team behind the startup, showcasing their expertise, experience, and passion for the business. Finally, it should include financial projections and funding requirements that demonstrate a realistic and achievable path to success. By including these key components in the pre-seed pitch deck, SaaS marketplace startups can effectively communicate their vision and potential to potential investors.

Crafting a Compelling Story for Startup Funding in the SaaS Marketplace

Crafting a compelling story is essential for capturing the attention of potential investors in the SaaS marketplace. A well-told story can create an emotional connection with investors and effectively communicate the vision and potential of the startup. When crafting a story for startup funding, it is important to focus on the problem that the SaaS startup aims to solve and how it will make a meaningful impact on the market. This should be followed by a clear explanation of the solution that the startup offers, highlighting its unique value proposition and differentiation from competitors.

Furthermore, the story should showcase the passion and dedication of the founding team, emphasizing their expertise and commitment to driving the success of the business. It should also include real-life examples and case studies that demonstrate the potential of the SaaS marketplace startup and how it has already made an impact on its target audience. By crafting a compelling story that effectively communicates the vision, potential, and impact of the SaaS startup, entrepreneurs can capture the attention and interest of potential investors.

Understanding the Investor List for SaaS Marketplace Startups

Understanding the investor list is crucial for SaaS marketplace startups seeking funding. Identifying and targeting the right investors can significantly increase the chances of securing funding and finding strategic partners who can add value to the business. When creating a pre-seed pitch deck, it is important to research and understand the investment preferences, focus areas, and track record of potential investors. This will help startups tailor their pitch to align with the interests and expectations of investors, increasing the likelihood of a successful funding round.

Furthermore, startups should consider building relationships with investors before pitching to them, as this can help establish trust and credibility. By understanding the investor list and tailoring their pitch accordingly, SaaS marketplace startups can effectively communicate their value proposition and potential to potential investors, increasing their chances of securing funding and support for their business.

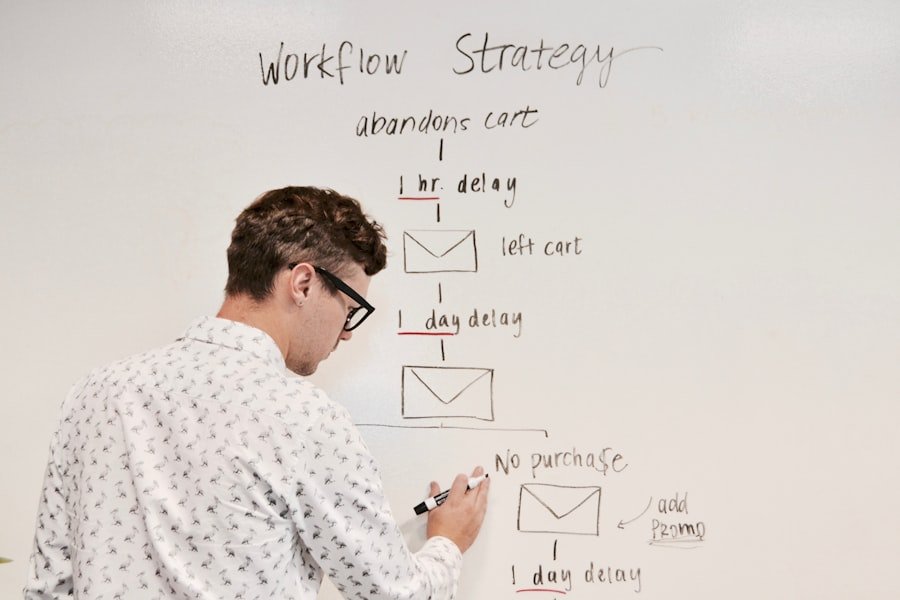

Design and Visual Elements for an Impactful Pre-Seed Pitch Deck

In addition to compelling content, design and visual elements play a crucial role in creating an impactful pre-seed pitch deck for SaaS marketplace startups. The design of the pitch deck should be visually appealing, professional, and consistent with the branding of the startup. This includes using high-quality images, clear and legible fonts, and a cohesive color scheme that reflects the identity of the business. Furthermore, visual elements such as charts, graphs, and infographics can help illustrate key data points and make complex information more digestible for potential investors.

Additionally, startups should consider incorporating multimedia elements such as videos or interactive prototypes to showcase their product or solution in action. This can help bring their vision to life and create a more engaging and memorable presentation for potential investors. By paying attention to design and visual elements, SaaS marketplace startups can create a pitch deck that not only communicates their value proposition effectively but also leaves a lasting impression on potential investors.

Tips for Delivering an Engaging Pre-Seed Pitch Presentation to SaaS Investors

Delivering an engaging pre-seed pitch presentation is essential for capturing the attention and interest of SaaS investors. To deliver an effective presentation, startups should focus on creating a clear and concise narrative that communicates their vision, value proposition, and potential impact on the market. This should be supported by compelling visuals, real-life examples, and data-driven insights that demonstrate the feasibility and potential of the business.

Furthermore, startups should practice their pitch delivery to ensure that they are confident, articulate, and engaging when presenting to potential investors. This includes rehearsing their presentation multiple times, seeking feedback from mentors or advisors, and refining their delivery based on audience reactions. Additionally, startups should be prepared to answer questions from investors and engage in meaningful discussions about their business during and after the presentation. By following these tips for delivering an engaging pre-seed pitch presentation, SaaS marketplace startups can increase their chances of securing funding and support for their business.

Next Steps for SaaS Marketplace Startups after Pitching to Investors

After pitching to investors, SaaS marketplace startups should be prepared to take proactive steps to follow up on their presentations and secure funding for their business. This includes sending personalized thank-you notes to investors who attended the pitch, providing additional information or materials as requested, and scheduling follow-up meetings or calls to further discuss their business.

Furthermore, startups should continue building relationships with potential investors even if they do not secure funding immediately. This includes keeping them updated on progress, milestones, and achievements of the business, as well as seeking feedback or advice on how to improve their pitch or business strategy. By staying engaged with potential investors and continuing to build relationships with them, SaaS marketplace startups can increase their chances of securing funding in the future and finding strategic partners who can add value to their business.

In conclusion, creating an effective pre-seed pitch deck is essential for SaaS marketplace startups seeking funding. By including key components such as a compelling story, understanding the investor list, designing impactful visual elements, and delivering an engaging presentation, startups can effectively communicate their vision and potential to potential investors. After pitching to investors, startups should be prepared to take proactive steps to follow up on their presentations and continue building relationships with potential investors. By following these steps, SaaS marketplace startups can increase their chances of securing funding and support for their business, laying the foundation for future growth and success in the competitive SaaS marketplace.

FAQs

What is a pre-seed pitch deck?

A pre-seed pitch deck is a presentation that entrepreneurs use to introduce their startup to potential investors. It typically includes information about the problem the startup is solving, the market opportunity, the team, the product or service, and the financial projections.

What should be included in a pre-seed pitch deck for marketplace investors?

A pre-seed pitch deck for marketplace investors should include information about the specific marketplace problem being addressed, the target market, the competitive landscape, the business model, the team’s expertise, and the go-to-market strategy. It should also include financial projections and a clear ask for investment.

How long should a pre-seed pitch deck be?

A pre-seed pitch deck should typically be around 10-15 slides long. It should be concise and to the point, providing enough information to pique the interest of investors without overwhelming them with details.

What are some tips for crafting an effective pre-seed pitch deck for marketplace investors?

Some tips for crafting an effective pre-seed pitch deck for marketplace investors include focusing on the problem being solved, clearly articulating the value proposition, showcasing the team’s expertise, providing evidence of market validation, and being transparent about the risks and challenges. It’s also important to tailor the pitch deck to the specific interests and concerns of marketplace investors.

How important is the design and visual appeal of a pre-seed pitch deck?

The design and visual appeal of a pre-seed pitch deck are important as they can help capture the attention of investors and make the information more engaging and memorable. However, the content and substance of the pitch deck are ultimately the most important factors in convincing investors to consider an investment.