Due diligence is a critical step in the acquisition of a Software as a Service (SaaS) company. The unique business model of SaaS companies, characterized by recurring revenue and customer retention focus, requires a comprehensive assessment of various factors. This process involves evaluating key financial metrics, revenue recognition practices, customer churn and retention rates, cost structure, profitability, debt levels, and potential risks and contingencies.

The due diligence process for SaaS acquisitions aims to understand the target company’s financial health and operational stability. It includes a thorough examination of financial statements, customer base, and operational processes to identify potential issues or areas of concern. Assessing the target company’s revenue recognition practices, cost structure, and debt levels provides a comprehensive view of its financial position.

By conducting rigorous due diligence, the acquiring company can make informed decisions, negotiate a fair valuation, and mitigate potential risks associated with the acquisition. This process is essential for ensuring a successful integration of the target company into the acquiring organization and maximizing the long-term value of the investment. Key areas of focus during SaaS due diligence include:

1.

Financial analysis: Examining historical and projected financial performance, including revenue growth, profitability, and cash flow. 2. Customer metrics: Evaluating customer acquisition costs, lifetime value, churn rates, and retention strategies.

3. Technology assessment: Reviewing the scalability, security, and intellectual property of the SaaS platform. 4.

Market position: Analyzing competitive landscape, market share, and growth potential. 5. Legal and regulatory compliance: Identifying any potential legal issues or regulatory risks.

6. Operational efficiency: Assessing the target company’s operational processes, team structure, and scalability. 7.

Integration planning: Evaluating the potential synergies and challenges of integrating the target company into the acquiring organization. Thorough due diligence helps acquiring companies make informed decisions, minimize risks, and maximize the potential value of their SaaS acquisitions.

Key Takeaways

- SaaS acquisition due diligence is crucial for assessing the financial health and potential risks of a target company.

- Key financial metrics such as ARR, MRR, and CAC are essential for evaluating the performance and growth potential of a SaaS company.

- Understanding revenue recognition practices is important for accurately assessing the company’s financial performance and future revenue streams.

- Evaluating customer churn and retention rates is critical for understanding the company’s ability to maintain and grow its customer base.

- Analyzing cost structure and profitability helps in determining the company’s efficiency and potential for long-term success.

Key Financial Metrics to Assess

Key Financial Metrics for SaaS Acquisition Due Diligence

When conducting due diligence for a SaaS acquisition, it is essential to carefully assess several key financial metrics that provide valuable insights into the target company’s financial performance and overall health.

Revenue and Growth Metrics

One important metric to consider is Monthly Recurring Revenue (MRR), which represents the predictable and recurring revenue generated from subscription-based services. The MRR growth rate is also a crucial metric to evaluate, as it indicates the company’s ability to acquire new customers and expand its recurring revenue base.

Customer Value and Acquisition Metrics

Another important metric is Customer Lifetime Value (CLV), which measures the total revenue that a customer is expected to generate over their entire relationship with the company. Assessing CLV helps to understand the long-term value of the customer base and the company’s ability to retain and monetize its customers. Additionally, it is essential to analyze the company’s Customer Acquisition Cost (CAC) and its ratio to CLV, which provides insights into the efficiency of the company’s sales and marketing efforts in acquiring new customers relative to their long-term value.

Profitability and Cost Structure Metrics

Furthermore, assessing the company’s Gross Margin and Operating Margin helps to understand its profitability and cost structure. A high gross margin indicates that the company is able to generate profits from its core operations, while a healthy operating margin demonstrates efficient cost management. By thoroughly evaluating these key financial metrics, the acquiring company can gain a comprehensive understanding of the target company’s financial performance and make informed decisions regarding the acquisition.

Understanding Revenue Recognition Practices

In the SaaS industry, revenue recognition practices play a crucial role in determining the financial performance and stability of a company. Unlike traditional businesses, SaaS companies typically recognize revenue over time as customers use their services, rather than upfront at the time of sale. This subscription-based model requires careful consideration of revenue recognition practices to accurately assess the company’s financial health.

It is important to understand how the target company recognizes its revenue, including any deferred revenue or contract liabilities that may impact its financial statements. Additionally, assessing the company’s customer contracts, billing practices, and renewal rates provides valuable insights into its revenue recognition practices. Furthermore, it is essential to evaluate the target company’s compliance with accounting standards such as ASC 606 (IFRS 15), which provide guidelines for revenue recognition in SaaS businesses.

Understanding how the company applies these standards and any potential impact on its financial statements is critical for conducting thorough due diligence. By gaining a deep understanding of the target company’s revenue recognition practices, the acquiring company can accurately assess its financial performance and make informed decisions regarding the acquisition. When it comes to SaaS acquisition due diligence, understanding revenue recognition practices is paramount for evaluating the financial health and stability of the target company.

Revenue recognition in SaaS businesses differs from traditional models, as it is typically recognized over time rather than upfront at the time of sale. This makes it essential to carefully assess how the target company recognizes its revenue, including any deferred revenue or contract liabilities that may impact its financial statements. Additionally, gaining insights into the company’s customer contracts, billing practices, and renewal rates provides valuable information for evaluating its revenue recognition practices.

Moreover, it is crucial to evaluate the target company’s compliance with accounting standards such as ASC 606 (IFRS 15), which provide guidelines for revenue recognition in SaaS businesses. Understanding how the company applies these standards and any potential impact on its financial statements is essential for conducting thorough due diligence. By gaining a comprehensive understanding of the target company’s revenue recognition practices, the acquiring company can accurately assess its financial performance and make informed decisions regarding the acquisition.

Evaluating Customer Churn and Retention

Customer churn and retention are critical factors to consider when conducting due diligence for a SaaS acquisition. Churn rate measures the percentage of customers who cancel their subscriptions or do not renew their contracts within a given period. A high churn rate can significantly impact a SaaS company’s recurring revenue and long-term growth prospects.

Therefore, it is essential to evaluate the target company’s churn rate and understand the reasons behind customer attrition. Additionally, assessing customer retention metrics such as renewal rates and expansion revenue from existing customers provides valuable insights into the company’s ability to retain and grow its customer base. Furthermore, understanding customer satisfaction levels and engagement metrics can help gauge the strength of the target company’s customer relationships.

High levels of customer satisfaction and engagement are indicative of strong customer loyalty and lower churn rates. By evaluating these factors, the acquiring company can gain a comprehensive understanding of the target company’s customer churn and retention dynamics, which are crucial for assessing its long-term growth potential. In addition to churn rate and retention metrics, it is important to assess the target company’s customer acquisition strategies and sales processes.

Understanding how the company acquires new customers and nurtures existing relationships provides valuable insights into its growth prospects and scalability. By thoroughly evaluating customer churn and retention dynamics, as well as customer acquisition strategies, the acquiring company can make informed decisions regarding the acquisition and develop strategies to mitigate potential risks associated with customer attrition.

Analyzing Cost Structure and Profitability

Analyzing cost structure and profitability is essential when conducting due diligence for a SaaS acquisition. Understanding the target company’s cost components, such as sales and marketing expenses, research and development costs, and general administrative expenses, provides valuable insights into its operational efficiency and scalability. It is important to assess the company’s Gross Margin, which measures its profitability from core operations after accounting for direct costs.

A high gross margin indicates that the company can generate profits from its services while covering its variable costs. Furthermore, evaluating Operating Margin helps to understand the company’s overall profitability after accounting for both direct and indirect costs. A healthy operating margin demonstrates efficient cost management and operational efficiency.

Additionally, assessing key profitability ratios such as Return on Assets (ROA) and Return on Equity (ROE) provides insights into the company’s ability to generate profits from its assets and equity investments. Moreover, it is essential to analyze the target company’s scalability and potential for future growth by assessing its cost structure relative to revenue growth. Understanding how changes in revenue impact cost structure and profitability helps to gauge the company’s ability to scale its operations efficiently.

By thoroughly analyzing cost structure and profitability metrics, the acquiring company can gain a comprehensive understanding of the target company’s financial performance and make informed decisions regarding the acquisition.

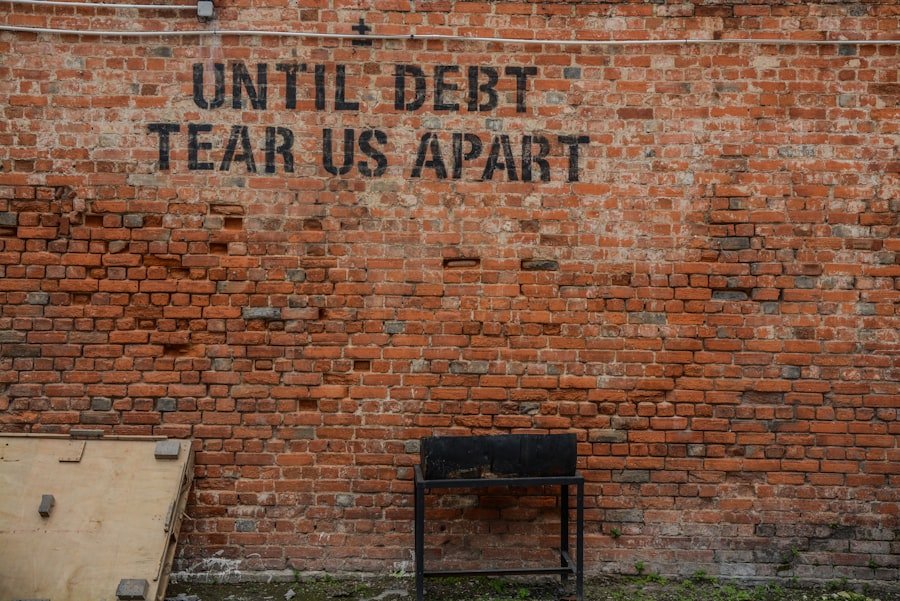

Assessing Debt and Financial Health

Debt Levels and Solvency

When conducting due diligence for a SaaS acquisition, it is crucial to assess the target company’s debt levels and overall financial health. This includes understanding the company’s debt obligations, such as long-term loans, lines of credit, or other forms of financing, which provides insights into its leverage and solvency. Key debt metrics, including the Debt-to-Equity ratio and Interest Coverage ratio, should be evaluated to gauge the company’s ability to meet its debt obligations and interest payments.

Working Capital Management and Cash Flow Dynamics

Analyzing working capital management and cash flow dynamics is essential to understand the target company’s liquidity position and ability to fund its operations. A healthy working capital position indicates that the company can cover its short-term liabilities using its current assets without relying heavily on external financing. Additionally, assessing cash flow from operating activities provides insights into the company’s ability to generate cash from its core business operations.

Overall Financial Health and Liquidity

Evaluating the target company’s overall financial health is critical to making informed decisions regarding the acquisition. This involves analyzing key financial ratios, such as the Current Ratio and Quick Ratio, which measure the company’s short-term liquidity position by comparing its current assets to current liabilities. By thoroughly assessing debt levels, working capital management, cash flow dynamics, and overall financial health, the acquiring company can gain a comprehensive understanding of the target company’s financial stability.

Identifying Potential Risks and Contingencies

Identifying potential risks and contingencies is a critical aspect of due diligence for a SaaS acquisition. It is important to conduct a thorough risk assessment to identify any potential challenges or uncertainties that may impact the target company’s future performance. This involves evaluating market risks such as competitive pressures, technological disruptions, or changes in regulatory environment that may affect the company’s growth prospects.

Furthermore, assessing operational risks such as reliance on key personnel or suppliers, cybersecurity threats, or potential disruptions in service delivery helps to understand potential vulnerabilities within the target company’s operations. Additionally, it is important to evaluate legal and compliance risks such as pending litigation, intellectual property disputes, or regulatory non-compliance that may pose significant challenges for the company. Moreover, identifying potential contingencies such as pending contracts or commitments, warranty obligations, or potential liabilities helps to understand any potential financial burdens that may impact the target company’s future cash flows or profitability.

By thoroughly identifying potential risks and contingencies, the acquiring company can develop strategies to mitigate these risks and negotiate appropriate terms for the acquisition agreement. In conclusion, conducting due diligence for a SaaS acquisition involves a comprehensive assessment of key financial metrics, revenue recognition practices, customer churn and retention dynamics, cost structure and profitability metrics, debt levels and financial health, as well as potential risks and contingencies. By thoroughly evaluating these factors, the acquiring company can gain a comprehensive understanding of the target company’s financial performance and operational stability.

This ultimately helps to mitigate potential risks associated with the acquisition and ensure a successful integration of the target company into the acquiring organization.

If you’re interested in learning more about SaaS acquisition due diligence, you should check out this article on SaaS Marketplace’s website. The article provides valuable insights into the key financial red flags to look out for when acquiring a SaaS company. It’s a must-read for anyone involved in the due diligence process. https://saas-marketplace.net/